If the cost of raw materials increases, the company will sell the higher-cost goods first. This is selling the most recent additions to your inventory first. That means the gross profit calculation may not reflect the actual figure. This is because all present inventory best represents the cost of the inventory most recently purchased.ĭisadvantage: The COGS reflects older historical costs. It asserts that the first materials and stock to come into inventory, will be the first out when sold.Īdvantage: This gives you a more accurate valuation of your current inventory. Many large manufacturers regard this as the “theoretically correct” inventory valuation method. Each has advantages and disadvantages. The three main options are:Ĭhoosing a Costing Method for COGS: FIFO, LIFO, or Average Cost First In, First Out (FIFO)

COGS FORMULA HOW TO

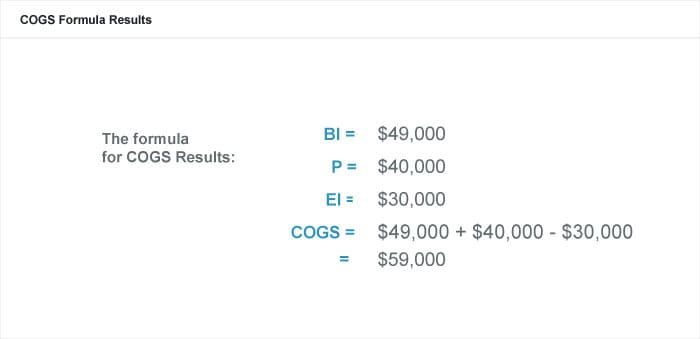

So how to value your inventory? This depends on the inventory costing method you use. You need to work out other forms of revenue and expenses for your net profit. Of course, this doesn’t take into account all your losses (and maybe not all your income). Include the direct labor cost as part of the inventory valuation. Don’t forget to include any inventory added in this time. Then find out the value of your inventory at the beginning and end of the chosen period.

Other metrics like leftover stock can also be taxable, so you need be on top of everything. The IRS makes sure they are reporting their income accurately. This means that COGS is serious business.Ĭalculating cost of goods sold is vital to know your taxable income. In the US, scaling manufacturers are routinely subject to tax audits. It is necessary to produce accurate tax statements, which shows your taxable income.It gives you important information about your business’ expenditure and.It pays to keep up with the price of getting your goods to market.ĬOGS tells you how much you spend to turn your raw materials into sold products. Your material and labor expenses could fluctuate from month to month. It’s a must-know for proper inventory management. In any case, the basic principles stay the same.ĬOGS is a method of giving a real-world valuation to your inventory. It’s up to each business owner to figure out what is best for their needs. You could calculate COGS every month, and also do a quarterly review to make sure everything lines up. Other businesses may only do this quarterly. This could be monthly, quarterly, or yearly. In short, cost of goods sold is how much it costs your business to sell inventory over a given period of time. It may be tempting to ignore or overlook it - this is not only bad practice, but bad for your margins. We’re here to show you there is a quick and easy solution designed for modern manufacturers.Ĭost of goods sold is one of the vital cogs in your manufacturing business. Your manufacturing business doesn’t have to get left behind. It is why big enterprises spend colossal amounts on accountants and legal advisers.

That’s how powerful good accounting practices are. Get on top of this important metric, and you can find ways to make more money - without gaining any more customers. When everything clicks into place, your business becomes much smarter by all accounts. It may be a pain at first, but stick at it. But there’s no need to get swamped by all the figures and financial jargon. Why is Knowing Cost of Goods Sold Important?Ĭost of goods sold (COGS) is another financial metric that can be difficult to wrap your head around.

0 kommentar(er)

0 kommentar(er)